Choosing a healthcare plan can be a daunting task, especially in retirement, when you need to stay on top of expenses and take care of your physical and mental health. That’s why Medicare Advantage plans, such as those offered by Humana, are becoming increasingly popular with millions of Americans. For the year 2024, the benefits of choosing a Humana Medicare Advantage plan over Original Medicare or any other provider are numerous and extensive. In this blog post, we’ll explore the advantages of Humana Medicare Advantage plans 2024 service that retirees can look forward to and how these benefits align with their healthcare needs.

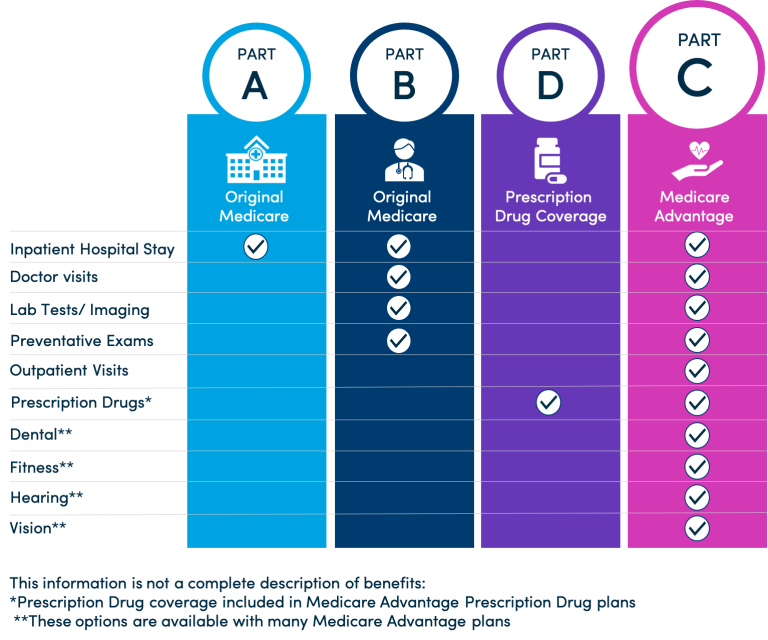

1. More Robust Coverage: Medicare Advantage plans are known for providing comprehensive coverage, with many plans offering additional benefits that aren’t available with Original Medicare, such as prescription drug coverage, vision and hearing care, dental care, and wellness programs. For the year 2024, Humana is offering plans with varying degrees of coverage, with some plans offering more flexibility, such as the ability to see out-of-network providers under certain conditions or lower cost-sharing options. Some plans, such as the Humana Honor, are designed for veterans and offer extra coverage to support their unique needs, such as emergency medical transport, mental health counseling, and caregiver support.

2. Low Out-of-Pocket Costs: In addition to comprehensive coverage, Medicare Advantage plans typically have lower out-of-pocket costs than Original Medicare, which can add up quickly, especially for those who need frequent medical care. Many Humana Medicare Advantage plans also have a maximum out-of-pocket limit, which is a cap on the amount members have to pay before the plan pays the rest of the costs. For 2024, Humana’s plans have an average maximum out-of-pocket limit of $7,550, which is lower than the national cap of $8,700.

3. Personalized Care: While Original Medicare works for some people, it may not always provide personalized care based on each individual’s specific needs. Medicare Advantage plans, on the other hand, are designed to provide tailored care, often through the use of care management programs, which help members minimize visits to emergency rooms, manage chronic conditions, and avoid unnecessary hospitalizations. Humana’s care management team assists customers in accessing community resources, finding a primary care physician, ensuring prescription coverage, and remaining in control of their care.

4. Telehealth: Telehealth is becoming increasingly popular for many reasons, one of which is its convenience. Medicare Advantage plans have been embracing telehealth solutions to provide members with the opportunity to connect with healthcare providers from the comfort of their own homes. Humana’s telehealth services are available across all its 2024 plans through the “Telemedically Enhanced Chronic Care Program.” Their platform offers video appointments, remote patient monitoring, and other digital health solutions to make health maintenance convenient for older adults who may have mobility challenges.

5. Affordable Plans: No Medicare Advantage plan will fit every individual’s budget, but Humana offers several plans to choose from. The costs vary based on a variety of factors, including location, level of coverage, and personal healthcare needs. However, in general, Humana’s Medicare Advantage plans are competitively priced and offer excellent value. By enrolling in a Humana plan, you can receive more benefits than offered by Original Medicare at a similar or even lower price.

When it comes to healthcare, there is no one-size-fits-all solution. However, the benefits of choosing a Humana Medicare Advantage plan make it a compelling option for many retirees. With comprehensive coverage, affordable plans, personalized care, and telehealth services, Humana stands out as a provider worth considering for anyone looking to make the most of their retirement years. With such an exhaustive range of benefits offered across varying plan options, finding a Humana policy that suits your needs may be easier than you think.